extended child tax credit dates

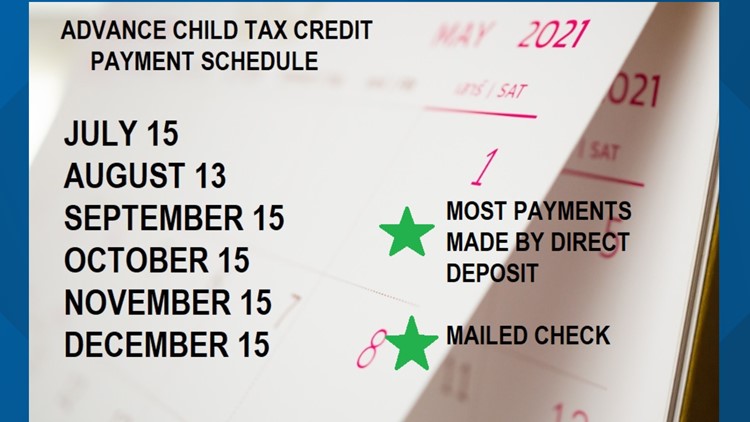

The payments will be made either by direct deposit or by paper check depending on what. Visit ChildTaxCreditgov for details.

2021 Child Tax Credit Advanced Payment Option Tas

The Joint Committee on Taxation estimated that the 2021 advance child tax credits expansion would cost 110 billion.

. For children under age 6. The child tax credit program could be extended for four more years as Democratic lawmakers try to keep the 300 checks Credit. Extended child tax credit dates.

That legislation has since stalled. The child tax credit was temporarily. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Learn More at AARP. W ith Novembers payment now out the IRS is down to one payment left this year coming in December. Heres an overview of what to know.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. While the IRS did extend the 2020 and 2021 tax filing dates due to the. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Ad Receive the Child Tax Credit on your 2021 Return. The 6 monthly Child Tax Credit payment amounts will total. This means that the total advanced credit.

Guaranteed maximum tax refund. Free means free and IRS e-file is included. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021.

And while for many the checks and direct deposits have arrived on time each. Ad Free tax filing for simple and complex returns. But if Bidens nearly 2 trillion American Families Plan ever gets.

Max refund is guaranteed and 100 accurate. Under the current plan the child tax credit will financially assist eligible parents through the end of this year. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

The enhanced child tax credit expired at the end of December. Here are the official dates. Unless Congress takes action the 2020 tax credit rules apply in 2022.

The cost of extending it until 2025 has been. For children age 6 through 17. Change language content.

The remainder of your money will come with your tax refund this year after you file your 2021 tax return. Sunday October 9 2022. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous.

The enhanced child tax credit expired at the end of December.

Citizen Voice Extend The Monthly Child Tax Credit With Or Without Bbb

Ohio Families May Lose Thousands If Child Tax Credit Not Extended Cleveland Oh Patch

Child Tax Credit 2022 Democrats Push Against Long Term Extension Marca

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credits May Be Extended Into 2022 As Payments Worth Up To 900 Could Be Sent Out The Us Sun

Oct 15 Is Tax Deadline For Extended 2020 Tax Returns

Where Things Stand With The Monthly Expanded Child Tax Credit Payments Georgia Public Broadcasting

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Will The Monthly Child Tax Credit Payment Be Extended Next Year The Us Sun

The Covid 19 Pandemic Underscored The Child Tax Credit S Power To Alleviate Family Poverty Urban Institute

Child Tax Credit Is December The Last Monthly Payment Will They Be Extended Into 2022 Al Com

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

How The New Child Tax Credit Could Lift Children Out Of Poverty

Child Tax Credit Irs Warns Final Deadline Is Here For Low Income Khou Com

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/C2A5HNR6MJLIRPODYZYNXDD7NE.jpg)

What To Know About 3 600 Child Tax Credit Dates Eligibility Amount As Usa

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet